Summary

The purpose of this guide is to assist provisional taxpayers with the following:

-

- Completion and submission of the Provisional Tax Return (IRP6).

- Calculation of the estimated taxable income for provisional tax payments.

- Calculation of penalties and interest payable on late or incorrect payments of provisional tax.

- This guide is published for information purposes only, so that provisional taxpayers can understand their tax obligations.

-

- It should not be considered as specific tax advice for an individual taxpayer.

- The guidelines and tax tables presented in this guide contain generic information to guide provisional taxpayers to correctly complete and submit the IRP6 return and to make the necessary payments on time.

- This document is intended to be used as a basic guide and is not for legal reference.

- Further guidance and assistance can be obtained from your nearest SARS or by calling Taxpayer Service on 0800 00 7277

General Information

- Provisional Tax is not a separate tax, but merely a mechanism to pay the normal income tax liability during the tax year. Therefore, Provisional Tax is an advance payment of a taxpayer’s normal tax liability.

- A provisional taxpayer is generally required to make two provisional tax payments, one six months into the year of assessment and one at the end of the year of assessment. Taxpayers may make an additional payment, generally known as the third or top-up payment, after the end of the year of assessment for the purpose of avoiding or reducing a liability for interest that would arise should their first two provisional payments be inadequate.

- Provisional tax payments are calculated on estimated taxable income, including current taxable capital gains, for that particular year of assessment. These estimates of taxable income are submitted to SARS on an IRP6 return. An IRP6 return can be requested, even if the amount of the provisional tax payment is nil, via the following channels:

-

- SARS eFiling at www.sarsefiling.co.za

- Nearest SARS or by calling Taxpayer Service on 0800 00 7277

- The return can be submitted via eFiling or at a SARS branch.

- The normal tax payable on the estimated taxable income is calculated at the relevant rate of tax that is in force on the date of payment of provisional tax.

-

- This would generally be the rate of tax as prescribed in the tax tables which are fixed annually by Parliament.

- The new provisional tax tables / rates and instructions in this publication are for the 2024 year of assessment for individuals, trusts and small business corporation (1 March 2023 – 29 February 2024).

- Provisional tax payments cannot be refunded or reallocated to different periods

- Provisional tax payments cannot be allocated to different taxpayers

- The provisional tax payments, together with any PAYE withheld during the year will be offset against the liability for normal tax at the end of the year of assessment.

- Any excess may be refunded after the taxpayer has been assessed for the relevant year of assessment; and any shortfall is payable by the taxpayer to

- Interest is generally payable from the effective date by SARS (in the case of a refund) and by the taxpayer (in the case of a shortfall).

- Paying the amounts due in terms of your provisional tax liability will prevent a large amount of tax (as well as penalties and interest) being due by you on assessment, as the tax liability will have been spread over a period of time prior to the issue of such assessment.

- The prescribed rate of interest applicable to late payments or to the under or overpayment of tax according to s187 of (the TAACT) and may change from time to time.

Governing Legislation

- The applicable legislation is the Income Tax Act No. 58 of 1962 (the Act), specifically the Fourth Schedule thereto (the Fourth Schedule), and the Tax Administration Act No. 28 of 211 (the TAACT).

- Where not specified, references to paragraphs would be to paragraphs of the Fourth Schedule, and references to sections would be to sections of the Act, unless the context indicates otherwise.

Who Is a Provisional Taxpayer?

- A ‘provisional taxpayer’ is:

-

- A person (other than a company) who earns income which is not remuneration, an allowance or advance as contemplated in section 8(1) or who earns remuneration from an employer that is not registered for employees’ tax

- A company; or

- A person notified by the SARS Commissioner that he/she is a provisional taxpayer.

- The following are specifically excluded from the payment of provisional tax:

- Public Benefit Organisations (PBOs) approved by SARS

- Recreational clubs approved by SARS

- Any Body-Corporate, share block company or association of persons contemplated in section 10(1) (e)

- Any natural person who does not derive income from the carrying on of any business, if in that relevant year of assessment –

-

- Taxable income does not exceed the tax threshold; or

- The taxable income from interest, dividends, foreign dividends, rental from letting fixed property and remuneration from an employer that is not registered for employees’ tax does not exceed R30 000

-

- Non-resident owners or charterers of ships and aircraft who are required to make payments under section 33

- Any small business funding entity

- Deceased estates.

Directors Of Private Companies & Members Of Close Corporation

- In terms of the definition of “employee” in subpar 1(g), directors of private companies (which include members of close corporations) are regarded as employees.

- Directors of private companies and members of close corporations are not automatically deemed to be provisional taxpayers unless they have other business income.

Estimates Of Taxable Income

- Provisional taxpayers (other than a company)

- Provisional taxpayers must, during every period, submit an estimate of the total taxable income which will be derived by the taxpayer in respect of the year of assessment for which the provisional tax is payable. This estimate must not include any retirement fund lump sum benefits, retirement fund lump sum withdrawal benefit or any severance benefit received by or accrued to the taxpayer during the relevant year of assessment. The return must be submitted even if the provisional tax calculation results in a nil payment.

- The taxable portion of the aggregate capital gain for the current year of assessment must be included in both the first and second provisional tax calculations

- The amount of estimate submitted by a provisional taxpayer shall not be less than the basic amount applicable to that particular estimate, unless the Commissioner after taking into account the circumstances of the case agrees to an estimate that is lower than the basic amount.

- The Commissioner may call upon a provisional taxpayer to justify any estimate, or to furnish particulars of the income and expenditure or any other particulars that may be required. If the Commissioner is dissatisfied with the estimate, he or she may increase it to what he or she considers reasonable, even if this is more than the basic amount. The increase of estimate is not subject to objection and appeal

- The ‘basic amount’ is the taxpayer’s taxable income assessed by the Commissioner for the latest preceding year of assessment, not less than 14 days before the date the taxpayer submits the provisional tax return LESS:

-

- The amount of any taxable capital gain;Taxable portion of a retirement fund lump sum benefit or retirement fund lump sum withdrawal benefit or severance benefit (other than any amount included under para (eA) of “gross income”);and

- Any amount, including any voluntary award received or accrued contemplated in paragraph (d) of “gross income” (excluding a severance benefit).

-

- Company Provisional taxpayers must submit a return of an estimate of the total taxable income which will be derived by the company in respect of the year of assessment.

- The basic amount is the taxpayer’s taxable income assessed by the Commissioner for the latest preceding year of assessment LESS the amount of any taxable capital gain in that year of assessment.

- The basic amount for all taxpayers must be increased by 8% if the estimate is made more than 18 months after the end of the latest preceding year of assessment

- The “year last assessed”, as shown on the IRP6 return, will refer to an assessment preceding the year of assessment for which the estimate is made, and for which a notice of assessment relevant to the estimate has been issued by SARS not less than 14 calendar days prior to the due date of such estimate.

- Estimates of taxable income and basic amount calculations:

- Example 1:

Statement for a provisional taxpayer with year of assessment ending on 28 February 2017:

-

- The notice of assessment for the 2016 tax year of assessment was issued on 15 August 2016

- The IRP6 for the 2017 tax year 1st period was submitted on the due date, 31 August 2016.

- The notice of assessment for the 2015 tax year of assessment was issued on 15 July 2015.

Solution:

- The notice of assessment of the 2016 year of assessment was issued 15 days before the date on which the provisional tax estimate for the first period of 2017 was submitted (the period between 15 August 2016 and 31 August 2016). Due to the 14 calendar days criteria being met, the latest preceding year is the 2016 tax year.

- The estimate is not made more than 18 months (the period between 28 February 2016 and 31 August 2016)

- Since the estimate is not made more than 18 months, therefore the basic amount will not be increased by 8%.

- The taxpayer’s basic amount will be based on the taxable income as assessed in 2016.

-

- Example 2:

Statement for a provisional taxpayer with the year of assessment ending on 28 February 2017:

- The notice of assessment for the 2016 tax year assessment was issued on 19 August 2016

- The IRP6 for the 2017 tax year 1st period was submitted on the due date, 31 August 2016

- The notice of assessment for the 2015 tax year of assessment was issued on 15 July 2015.

Solution:

- The notice of assessment of the 2016 year of assessment was issued 11 days before the date on which the provisional tax estimate was submitted. Therefore, the 2016 assessment does not meet the 14 calendar days criteria, and therefore the latest preceding year of assessment is the 2015 tax year of assessment

- The estimate is not made more than 18 months after the latest preceding year of assessment (the period between 28 February 2015 and the 31 August 2016)

- Therefore, the basic amount will not be increased by 8%

- The basic amount will be the amount of taxable income as assessed in 2015.

-

- Example 3

Statement for a provisional taxpayer with the year of assessment ending on 28 February 2017:

- The notice of assessment was issued for the 2013 tax year on 30 June 2013

- The taxable income as assessed in 2013 was R260 000 and included a taxable R25 000 and severance benefit of R40 000

- The IRP6 for the 2017 tax year 1st period was submitted on the due date, 31 August 2016

- The 2014, 2015 and 2016 tax returns have not been submitted.

Solution:

- The 2013 notice of assessment was issued more than 14 calendar days before the date on which the provisional tax estimate was submitted on 31 August 2016.The 2014, 2015 and 2016 tax returns have not been submitted.

- The estimate is submitted more than 18 months (the period between 28 February 2013 and 31 August 2016) after the end of the last preceding year (2013)

- The basic amount for 2013 is calculated as follows:

-

- Taxable income assessed in 2013 R260 000

- Less: Taxable capital gain R 25 000

- Less: Severance benefit R 40 000

- R195000

- The basic amount (R195 000) must be increased by 8% for each year from 2013 to 2017, therefore R257 400 [R195 000 + (R195 000 x 8% x 4)] is the basic amount for the 2017 tax year.

Justification of an Estimate by The taxpayer

- In terms of paragraph 19(3), a provisional taxpayer may be asked to justify any estimate made or to furnish full particulars of income, expenditure and/or any other particulars that may be required.

-

- If SARS is not satisfied with the response, the estimate may be increased to an amount which is considered reasonable.

- This increase of the estimate by SARS is not subject to objection and appeal.

- SARS will notify the taxpayer and issue a revised estimate which will be used to calculate your provisional tax liability.

-

- Refer to “Interpretation Note 1 (Issue 3) of 20 February 2019” which is available on the SARS website (sars.gov.za) for more information.

Form used to Capture Provisional Tax Calculations

- An IRP6 return must be completed for provisional tax purposes.

- The IRP6 return can be completed for all types of taxpayers:

-

- Individuals

- Trusts

- Companies

- A provisional taxpayer is required to request and submit a return (IRP6) for the first and second period even if, according to the result of the provisional tax calculation, the total amount of tax due and payable is ‘Nil’ (0).

Failure to Submit a Provisional Tax Return (IRP6)

- The Commissioner may estimate the taxable income and determine the amount payable; if the provisional taxpayer fails to submit an estimate for any particular period.

- The estimate made by the Commissioner is effective for the relevant period within which the provisional taxpayer is required to make the payment for provisional tax.

How is Provisional Tax Calculated

- There are two compulsory provisional tax payments in respect of a year of assessment based on the estimated taxable income.

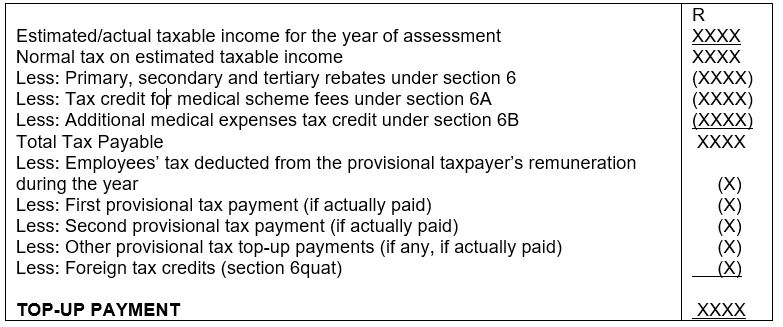

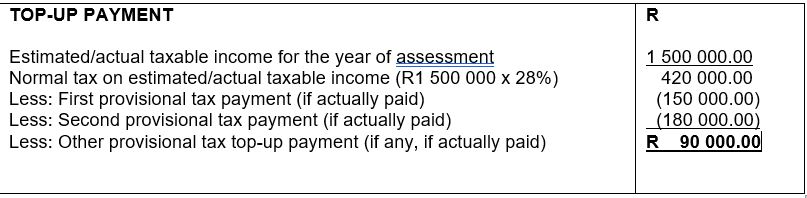

- There is also a third “voluntary top-up” or “additional” provisional payment, but unlike the first and second payments, the third payment is often based on the actual taxable income for the year.

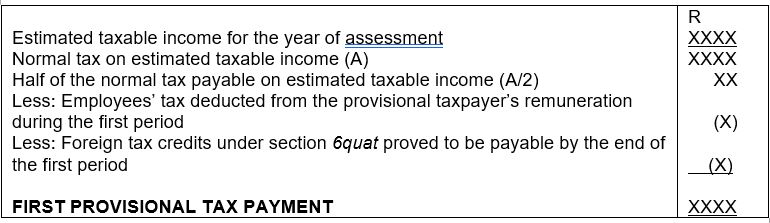

Provisional Taxpayers other Than Companies

Note 1: Refer to the attached annexures for detailed calculations.

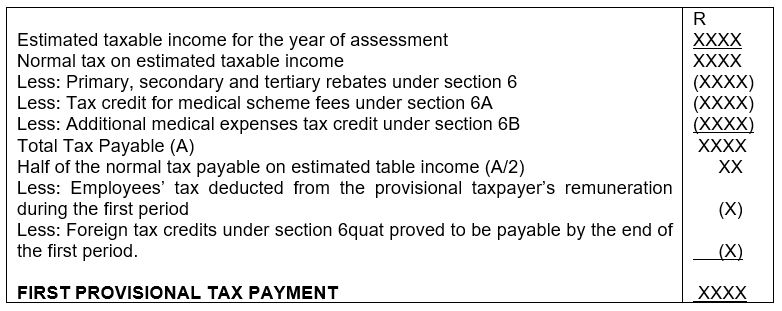

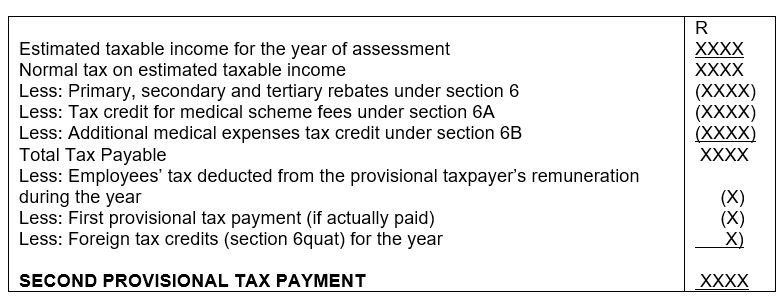

- The first period provisional tax payment is calculated as follows.

Note 2:

-

- The rebate available under section 6quin was deleted for years of assessment commencing on or after 1 January 2016.

- This means that the section 6quin deduction is not available from the 2017 year of assessment

- The third period (top-up/voluntary) provisional tax payment is calculated as follows:

Note 3:

-

- The rebate available under section 6quin was deleted for years of assessment commencing on or after 1 January 2016.

- This means that the section 6quin deduction is not available from the 2017 year of assessment.

- The third period (top-up/voluntary) provisional tax payment is calculated as follows:

Note 4:

-

- The rebate available under section 6quin was deleted for years of assessment commencing on or after 1 January 2016.

- This means that section 6quin deduction is not available from the 2017 year of assessment.

Foreign Tax Rebates

- Section 6quat

-

- Provides for foreign tax rebate in respect of foreign tax on income from a non-South African source.

- This rebate allows against South African tax, any foreign tax paid or payable (converted to rands) included in the South African taxable income of the resident

- Due to the deletion of section 6quin, provisional taxpayers will be granted a deduction in terms of section 6quat (1C) as opposed to a tax credit against tax

- In terms of section 6quat (1C), provisional taxpayers will be entitled to claim a deduction from income for services rendered in South Africa and taxed outside South Africa as from the 2017 year of assessment.

- Section 6quin

-

- The rebate available under section 6quin was deleted for years of assessment commencing on or after 1 January 2016

- Detailed information on foreign tax credit is accessible on the SARS website (sars.gov.za).

Medical Scheme Fees Tax Credit

- Effective from 1 March 2012 the current medical scheme contribution deduction for taxpayers below 65 years of age, was replaced by medical tax credit.

-

- With effect from 1 March 2014, persons over the age of 65 years or older are also entitled to the medical scheme fees tax credit contribution as a deduction.

- This rebate is deducted from the normal tax payable by a natural person.

- The medical scheme fees tax credit is applicable to fees paid by the person to a medical scheme registered under the Medical Schemes Act, or a fund which is registered under any similar provision contained in the laws of any other country where the medical scheme is registered.

- The tax credit is applicable in respect of fees paid by the taxpayer to a registered medical scheme.

- The number of persons (dependents) for whom the contributions to a medical scheme determines the value of credit, and the medical scheme contribution tax credit is as follows:

-

- R364 in respect of the person who has paid the contribution;

- R364 in respect of the person’s first dependent;

- R246 in respect of the benefits to each additional dependent.

Additional Medical Expenses Tax Credit

- A further medical expenses tax credit amount in addition medical scheme fees tax credit is deducted from the normal tax payable by a person who is a natural person.

- A person who is 65 years or older or an individual, his or her spouse, or his or her child is a person with a disability is eligible for 33.3% of the aggregate of the full medical scheme contributions in excess of three (3) times the credit plus 33.3% of all other qualifying out of pocket medical expenses paid by that person (excluding medical scheme contributions).

- Persons below 65 years are entitled to 25% of the aggregate of the full medical scheme contributions in excess of four (4) times the plus all other qualifying out of pocket medical expenses (excluding medical scheme contributions), only to the extent that the amount exceeds 7,5% of the taxable income excluding retirement fund lump sums and severance benefits.

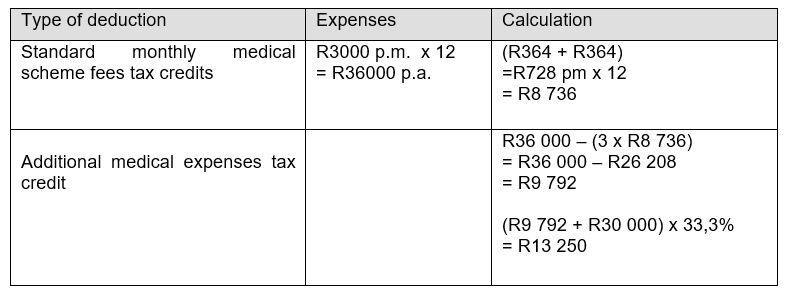

- Example – Person 65 years and older

-

- Statement:

-

-

-

- ABE is 65 years old and he has made R3000 contribution per month to a medical scheme for himself and his wife from 1 March 2023

- His qualifying medical expenses by 29 February 2024 is R30 000.

-

-

-

-

- Solution:

-

-

- Therefore, Mr ABE’s tax liability will be reduced by R21 986 [R8 736 (medical scheme fees + R13 250 (additional medical expenses)]

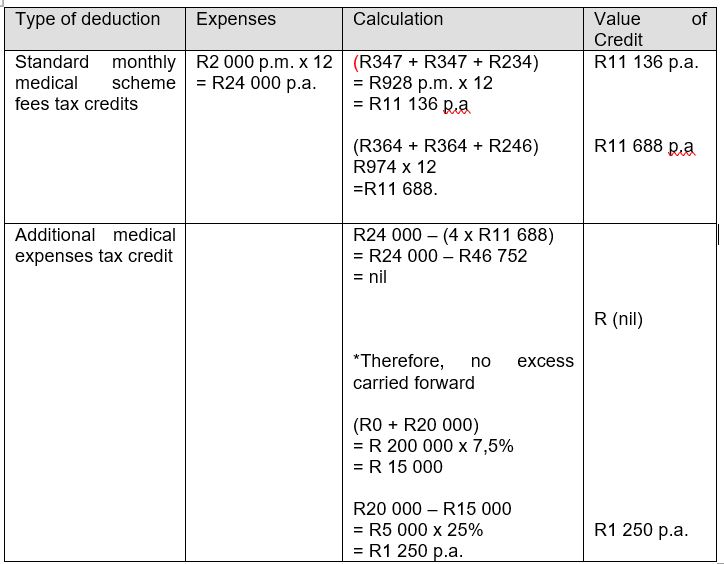

- Example – Person under 65 years

-

- Statement:

-

-

- Ms .PAS is 45 years old and she has made R2 000 contributions to the medical scheme per month on behalf of herself and her two children

- By 29 February 2024 she incurred R20 000 in qualifying medical expenses

- Her taxable income for the 2024 tax year is R200 000.

-

-

- Solution:

- Therefore, Ms. P PAS’s tax liability will be reduced by R12 938 [R11 688 p.a. medical scheme fees) + R1 250 additional medical expenses)].

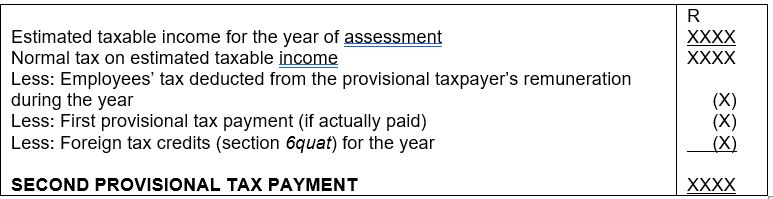

Provisional Taxpayers who Are Companies

Note 1: Refer to the attached annexures for detailed calculations.

- The first period provisional tax payment is calculated as follows:

Note 2:

-

- The rebate available under section 6quin was deleted for years of assessment commencing on or after 1 January 2016.

- This means that section 6quin deduction is not available from the 2017 year of assessment.

- The second period provisional tax payment is calculated as follows:

Note 3:

-

- The rebate available under section 6quin was deleted for years of assessment commencing on or after 1 January 2016

- This means that section 6quin deduction is not available from the 2017 year of assessment.

- The third period (top-up/voluntary) provisional tax payment is paid in addition to the amounts that must be paid at the end of the first and second provisional tax periods. The payment is made to reduce the interest on underpayment of provisional tax prior to the effective date. The third period provisional tax payment is calculated as follows:

When Must Provisional Tax Be Paid

- In terms of paragraphs 21, 23, 23A, and 25(1) the due dates for payments are:

-

- First period: This payment must be made within six months from the commencement of the year of assessment in question.

This means that for the year of assessment that starts on the 1 March and end on the 28/29 February, the first period for which provisional tax becomes due will be the period ending 31 August.

-

- Second period: This payment must be made not later than the last day of the year of assessment in question.

This means that for the year of assessment that starts on the 1 March and end on the 28/29 February, the second period for which Provisional Tax becomes due will be the period ending on the 28/29 February.

- The provisional tax return and payment for the “first” period is not required in instances where the duration of the year of assessment does not exceed a period of six months as a result of e.g. death, ceasing to be a tax resident, company being incorporated during the year or if there has been a financial year end change for the company.

- Half of the Provisional Tax liability is payable within 6 months after the commencement of the year of assessment for companies, and it is based on the total estimated liability for the company. An amount that is equal to the total estimated liability is payable within the period ending on the last day of the year, less the amount paid for the first period, employees’ tax deducted by the taxpayer’s employer from the taxpayer’s remuneration, and any tax payable to the government of any country which will qualifies for a rebate.

- Payment of Provisional Tax upon an assessment notice issued by SARS must be done within the period specified in such notice.

- Example of payment dates

-

- The following example refers to a 28 February 2021 year-end (2021 tax year):

-

-

- First provisional tax payment due on 31 Aug 2020

- Second provisional tax payment due on 28 Feb 2021

- Third or voluntary payment due on 30 Sept 2021

- The following example refers to a 31 May 2021 year-end (2021 tax year):

- First provisional tax payment due on 30 Nov 2020

- Second provisional tax payment due on 31 May 2021

- Third or voluntary payment due on 30 Nov 2021

-

- The following methods to effect payments to SARS are available:

-

- At your bank

- Via eFiling

- Via Electronic Funds Transfer (EFT)

- Where payments are made electronically, provision must be made for your bank’s cut-off times and for a clearance period that could take between two and five days.

- Bank payments – taxpayers paying over the counter at any ABSA, FNB, Nedbank or Standard Bank branch will no longer need to supply a bank account number and bank code when making payments. This applies equally to all internet-banking clients of ABSA, Capitec Bank, FNB, Investec, Mercantile Bank, Nedbank and Standard Bank.

-

- All that will be required is:

-

-

- The client’s 19-digit payment reference number

- The beneficiary ID/account number which is linked to a specific type of tax to make payments

- These details are reflected on the payment advice of the IRP6 return.

- Payments that do not comply with both the above-mentioned payment reference number and the beneficiary ID will not be accepted.

-

- If the last day for payment falls on a public holiday or weekend, the payment must be made on the last working day prior to the public holiday or weekend. For more details refer to the SARS website sars.gov.za

- For detailed information on payments refer to the ‘External Guide South African Revenue Payment Rules’.

Deferral of Payment – Instalment Payment Agreement (In Terms of s167 of taact)

- A senior SARS official may enter into an agreement with a taxpayer in the prescribed form under which the taxpayer is allowed to pay a tax debt in one sum or in instalments, within the agreed period if satisfied that:

-

- Criteria or risks that may be prescribed by the Commissioner by public notice have been duly taken into consideration; and

- The agreement facilitates the collection of the debt

- The agreement may contain such conditions as SARS deems necessary to secure collection of tax.

- SARS may terminate an instalment payment agreement if the taxpayer fails to pay an instalment or to otherwise comply with its terms and a payment prior to the termination of the agreement must be regarded as part payment of the tax debt.

- The agreement remains in effect for the term of the agreement except if:

-

- A senior SARS official may modify or terminate an instalment payment agreement if satisfied that either:

-

-

-

- The collection of tax is in jeopardy;

- The taxpayer has furnished materially incorrect information in applying for the agreement;

- The financial condition of the taxpayer has materially changed.

-

-

- A termination or modification

-

- Takes effect as at the date stated in the notice of termination or modification sent to the taxpayer; and

- Takes effect 21 business days after notice of the termination or modification is sent to the taxpayer.

Note: Section 167 of TAACT is only applicable to tax debt that arise as a result of the issued assessment. Therefore, the deferral of payment in terms of section 167 of TAACT does not apply to provisional tax.

- A senior SARS official may enter into an instalment payment agreement only if any of the following applies:

-

- The taxpayer suffers from a deficiency of assets or liquidity which is reasonably certain to be remedied in the future;

- The taxpayer anticipates income or other receipts which can be used to satisfy the tax debt;

- Prospects of immediate collection activity are poor or uneconomical but are likely to improve in the future;

- Collection activity would be harsh in the particular case and the deferral or instalment agreement is unlikely to prejudice tax collection; or

- The taxpayer provides the security as may be required by the official.

Interest on Underpayment of Provisional Tax

- 89bis interest

-

- Interest in terms of section 89bis is levied at the prescribed rate (currently 7.25% per annum subject to changes as published in Government Gazette) is payable on late payments in respect of first, second and third periods

- 89quat interest

-

- Interest in terms of section 89quat is either levied on an underpayment of tax or paid on an overpayment of tax from the ‘effective date’. See below for an explanation of the ‘effective date’.

- 89quat(2) interest

-

- Interest in terms of section 89quat(2), is payable by a provisional taxpayer if the normal tax exceeds the ‘credit amount’ (i.e. an underpayment of tax) and if in the case of:

- An individual or trust, the taxable income for the year of assessment exceeds R50000, or

- A company, the taxable income for the year exceeds R20 000.

- This interest is levied at the prescribed rate (currently 7.25% per annum subject to changes as published in Government Gazette) in terms of section 89(2) and is calculated from the day following the ‘effective date’ to the day before the first due date on the relevant assessment notice.

- Interest on underpayment of Provisional Tax paid by a taxpayer is not a tax-deductible expense.

- Example-89quat(2) interest:

- First due date on assessment notice is 1 December 2019,interest on underpayment for the 2019 year of assessment (February year-end) will be calculated from 1 September 2019 to 30 November 2019.

- Interest in terms of section 89quat(2), is payable by a provisional taxpayer if the normal tax exceeds the ‘credit amount’ (i.e. an underpayment of tax) and if in the case of:

Penalties

- Paragraph 20 penalty in the event of taxable income being underestimated:

-

- A penalty will be levied under certain circumstances where it has been determined that the actual taxable income is more than the taxable income estimated on the second provisional tax return.

- The penalty amount depends on whether the actual taxable income is more or less than R1 million.

- The penalty may be levied even if the Commissioner has increased the estimate in terms of paragraph 19(3). The second estimate that has been submitted by the taxpayer is used to determine if the estimate is more or less than R1 million.

- If a person does not submit the final estimate (which is the 2nd IRP6) by the relevant due date, the taxpayer would be deemed to have submitted an estimate of an amount of nil taxable income unless the 2nd IRP6 is submitted within four months after the end of the relevant year of assessment

- Certain once-off amounts such as a retirement fund lump sum benefit, retirement fund lump sum withdrawal benefit or severance benefit payments, are excluded from the calculation of the penalty, however any amount contemplated in paragraph (d) of the definition of ‘gross income’ is included in the penalty calculation

- A penalty levied for the underestimation of actual taxable income on the second period; is reduced by the penalty imposed for the late payment of provisional tax under paragraph 27

- If the Commissioner is satisfied that the failure to submit such an estimate timeously was not due to intent to evade or postpone the payment may remit the whole or any part of the penalty.

- Provisional taxpayers with a taxable income of up to R1 million

-

- Where the estimate is less than 90% of the actual taxable income and also less than the basic amount, a penalty is levied (deemed to be a percentage based penalty under Chapter 15 of the TAACT equal to 20% of the difference between

- The lesser of –

- The amount of normal tax calculated in respect of a taxable income equal to 90% of such actual taxable income (after taking into account any amount of deductible rebates); and

- The amount of normal tax calculated in respect of a taxable income equal to such basic amount (after taking into account any amount of deductible rebates); and

- The amount of employees’ tax and provisional tax paid by the end of that year of assessment

- Any retirement fund lump sum benefit, retirement fund lump sum withdrawal benefit or severance benefit received/accrued should be excluded from the above penalty calculation.

- The lesser of –

- Where the estimate is less than 90% of the actual taxable income and also less than the basic amount, a penalty is levied (deemed to be a percentage based penalty under Chapter 15 of the TAACT equal to 20% of the difference between

Example – Provisional taxpayer with a taxable income of up to R1 million

-

-

- Statement relating to Mr. XY for year of assessment ending 28 February 2021:

-

- Mr. XY is a provisional taxpayer and he is required to submit his provisional tax returns for the 2015 year of assessment

- Mr. XY’s basic amount of R300 000 is based on the notice of assessment for the 2014 year of assessment

- His expected taxable income will be less than the basic amount as a result of poor trading conditions. He submitted his first and second period’s estimates with taxable income of R200 000 for the year

- On assessment Mr. XY’s final taxable income was determined as R280 000 for the year.

- His provisional tax payment for the year amounted to R38 408.00, and no employees’ tax was not paid.

-

- Solution

-

- The first step – determine whether the final estimate of taxable income less than 90% of actual taxable income and less than basic amount?

-

- Statement relating to Mr. XY for year of assessment ending 28 February 2021:

-

Final estimate of provisional taxable income =R200 000

Basic amount (2014 YOA) = R300 000

Actual taxable income (2015 YOA) = R280 000

Therefore,

Actual taxable income is less than

-

- 90% of final provisional taxable income (R280 000 x 90% = R252 000) and

- Basic amount (R300 000)

-

-

-

-

- The second step – determination of the penalty

-

-

-

20% of the difference between – the lesser of

-

-

-

-

- tax on 90% of R252 000 taxable income = R51 408; and

- tax on basic amount of R300 000 = R65 471

-

-

-

Therefore,

-

-

-

-

- R52 408 less R38 408 (provisional tax payment) = R13 000

- R13 000 x 20% = R2 600 (para 20(1)(b) penalty)

-

-

-

-

-

-

-

- Note – if the taxpayer had received a penalty in terms of para 27 for late payment of provisional tax, the above penalty must be reduced by para 27 amount (see para 20(2B))

-

-

-

Example:

Para 20(1)(b) penalty = R2 600

Para 27 penalty = R1 000

Therefore, final para 20(1)(b) penalty due by taxpayer = R1 600

- Provisional taxpayers with a taxable income above R1 million

-

- A penalty, which is deemed to be a percentage based penalty imposed under Chapter 15 of the TAACT; will be equal to 20% of the difference between –

-

- The amount of normal tax as determined in respect of such estimate, and the amount of normal tax calculated after taking into account any amount of deductible rebates, at the rates applicable in respect of such year of assessment, in respect of a taxable income equal to 80% of such actual taxable income; and

- The amount of employees’ tax and provisional tax paid by the end of that year of assessment. Any retirement fund lump sum benefit, retirement fund lump sum withdrawal benefit or severance benefits received/accrued should be excluded from the penalty calculation.

-

- A penalty, which is deemed to be a percentage based penalty imposed under Chapter 15 of the TAACT; will be equal to 20% of the difference between –

- Paragraph 20A penalty for failure to submit an estimate of taxable income timeously

- This penalty has been deleted with effect from years of assessment commencing on or after from 1 March 2015

- Paragraph 27 penalty on late payment of Provisional Tax

- A penalty, which is deemed to be percentage-based penalty imposed under Chapter 15 of the TAACT of 10% will be levied on any late payment of Provisional Tax in respect of the first and second periods

Specific Definitions

- The ‘effective date’ is:

- Where the year of assessment ends on 28/29 February for any taxpayer, 7 months thereafter

- Where the year of assessment ends on 28/29 February, but the Commissioner approved a financial year end on a date other than 28/29 February, six months thereafter

- In any other case, six months after the relevant year of assessment

- The ‘credit amount’ in respect of a provisional taxpayer is the sum of:

- All Provisional Tax payments (1st, 2nd and 3rd) made

- Employees’ Tax paid

- Allowable Foreign Tax credits for the applicable year of assessment.

General Information on Trusts

-

- Section1 defines a Trust as:

-

-

- A trust consists of cash or other assets that are administered and controlled by a person, known as a trustee, who acts in a fiduciary capacity. Such person is appointed in terms of a deed of trust, by agreement or in terms of the will of a deceased person.

-

-

- A Special Trust is:

- A trust created solely for the benefit of a person who has a disability as defined in 6B(1) of the Act, where such disability incapacitates such person from earning sufficient income to maintain him/herself; or is incapable of managing his/her own financial affairs.

- This Trust will no longer be deemed to be a special trust in respect of years of assessment ending on or after the date on which such person is deceased

- Where such Trust is created for the benefit of more than one person, all persons for whose benefit the trust is created must be relatives in relation to each other

- A Trust created in terms of the will of a deceased, solely for the benefit of beneficiaries who are relatives in relation to that deceased person and who are alive or conceived but not yet born on the date of the death of the deceased person, where the youngest of those beneficiaries is on the last day of the year of assessment of that trust under the age of 18 years

- A trust created solely for the benefit of a person who has a disability as defined in 6B(1) of the Act, where such disability incapacitates such person from earning sufficient income to maintain him/herself; or is incapable of managing his/her own financial affairs.

- Trusts (including a special trust that is taxed according to sliding scale applicable to a natural person) do not qualify for interest exemption or personal rebates.

- Trusts are taxed at a flat rate of 45% except for Special Trusts which are taxed according to the tax rates applicable to natural persons. For additional examples of the taxable income calculation for a Trust refer to attached annexures.

- A Special Trust is: